Have you ever heard of the domino effect? How about the snowball effect? The first time I grasped the concept was after taking a Financial Peace course from Dave Ramsey. The idea is simple in theory but difficult in application because it involves discipline and sacrifice.

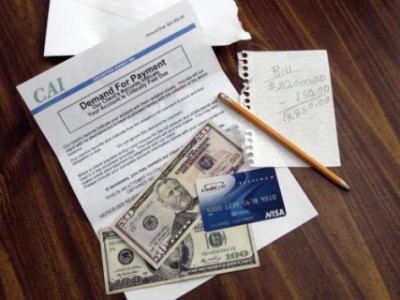

So, how exactly does this work? Start off by identifying all of your debt and writing them down in order from the least amount owed to the greatest regardless of percentage rates and monthly payment. Once the debt is written down, the snowball idea begins.

Each month you will continue making your minimum monthly payments on your accounts, but beginning with your least amount of debt, pay whatever additional amount you have left over in your budget on top of the minimal amount. If you have nothing in addition to contribute to the monthly minimum, then continue to make the monthly payment until that debt is paid off doing what you can to add to the minimum amount. Once the first debt is paid off, you move to the next one just like building a snowman. The minimum monthly amount you were paying towards that first debt is to be added on to the next lowest debt therefore increasing your payment towards the next debt and so on and so forth. Do you see the snowball being built?

Although the theory is highly practical, the following through is the most difficult part since it takes time to lay out your plan, discipline to stay on target, and sacrifice to give up something that you may usually treat yourself to, but instead chose to put it towards your debt to keep the snowball going.

I can tell you from my own experience the joy that comes knowing that you do not have a monthly car payment to worry about or a credit card bill that is a 0 balance. (As a side note-I suggest cutting up your credit cards as a visual decision to no longer spend more than you earn.) Instead, I can continue snowballing on down the line in knocking out my debt.

Dave Ramsey is not the only one with this simple principal. There are others who suggest the same road map to follow. However, there is one common thread in all of these applications. They are biblical.

As one who is in debt, it is easy to understand what God means when he says “the borrower becomes the lender’s slave” (Proverbs 22:7) If you are in debt, I suggest that you try to apply these biblical principals to your life. I believe that as the debt begins to roll away, the freedom from the lender will come.

Additional information about snowballing your debt

The Bottom Line, Ministries Christian News, Articles, & Poetry

The Bottom Line, Ministries Christian News, Articles, & Poetry